Table of Contents

Tesla stock price prediction 2030 has investors talking with very different expert forecasts. Financial analysts project Tesla’s shares could reach anywhere from $438 to over $3,600 by 2030, showing how split opinions are about the company’s future.

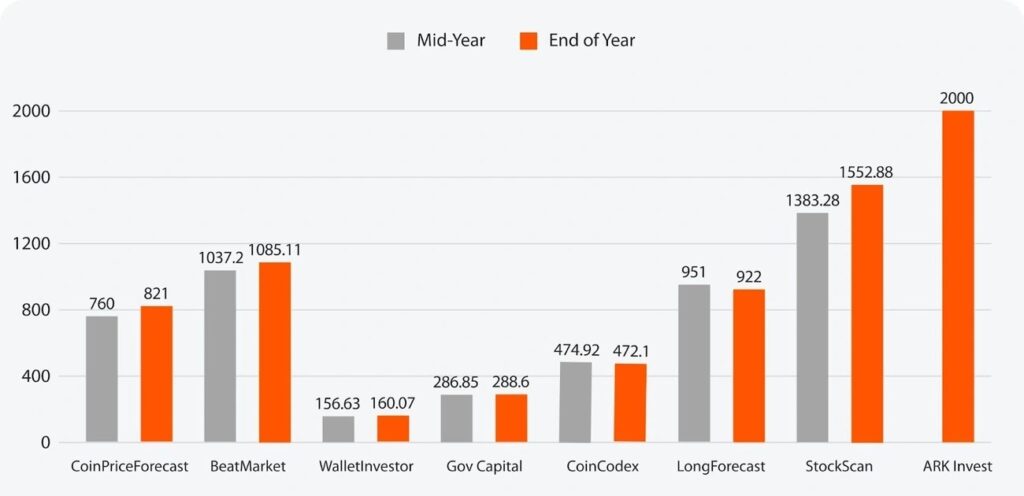

CoinCodex expects Tesla stock to go up by 46.69% and reach $630.51 per share in November 2025. Other analysts think Tesla could hit $1,003 by 2030. Cathie Wood has an even more optimistic view, saying Tesla shares will jump to $2,600 by 2030. At the same time, StockScan forecasts a remarkable $3,600 by 2035.

Why such different predictions? It all boils down to how analysts see Tesla’s future. Some zero in on Tesla’s plans to boost production to 2.5 million vehicles by 2025. Others think the company’s robotaxi platform will spark huge growth. Money forecasts show Tesla’s revenue could hit $127.61 billion in 2025, up from $107.12 billion in 2024.

In this article, we’ll dig deep into Tesla stock price prediction 2030, what experts think could drive growth, and what hurdles might slow it down.

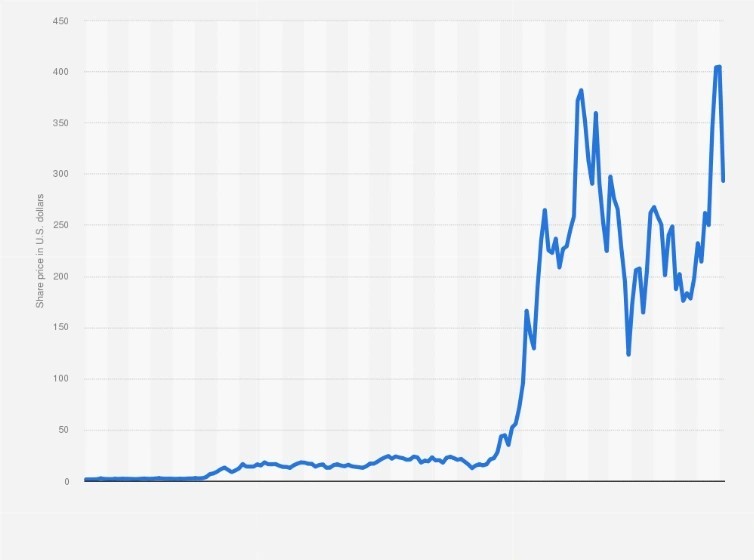

Tesla’s Stock Journey from 2010 to 2025

Taking a look at Tesla’s stock history shows a wild ride that not many investors could have seen coming. From its small start to becoming one of the stocks everyone watches, Tesla’s story gives us a good background to understand future price guesses. Understanding Tesla’s past helps make sense of Tesla stock price prediction 2030, since its future potential is built on past performance.

IPO to Model S: How the Market First Reacted

Tesla hit the stock market in June 2010, selling shares for just $17. At first, the stock didn’t do much as investors weren’t sure if a company making only electric cars could make it. In the early years, Wall Street experts didn’t believe Tesla could make enough cars.

When Tesla launched the Model S in 2012, it changed everything. This high-end sedan proved that electric cars could be both appealing and useful. Even with this game-changing product, the stock price went up and down like a roller coaster. During this time, short sellers kept attacking Tesla, betting the company would miss its big targets.

In 2013, the stock had its first big jump, going over $150 as the Model S won many car of the year titles. This time showed how Tesla kept proving its critics wrong while dealing with making enough cars, a pattern that would keep happening throughout its story.

Model 3 and Shanghai Gigafactory Impact

Tesla’s announcement of the Model 3 in 2016 signaled its move from luxury to the mass market. This led to a new growth phase for the stock as pre-orders beat all expectations. Yet, the actual production increase turned into what Elon Musk dubbed “production hell.”

In 2018-2019, Tesla chose to build its Shanghai Gigafactory, which had a huge impact on the company’s future. This entry into China, the biggest EV market worldwide, quieted many critics. Also, the factory’s quick construction – from start to finish in under a year – proved that Tesla’s manufacturing skills had improved.

The Model 3’s production increase and global expansion had an impact on the stock price. It jumped from about $300 in early 2019 to almost $900 by early 2020. This jump caught even optimistic analysts off guard.

COVID-19 Boom and S&P 500 Inclusion

Tesla flourished while many companies struggled during the pandemic. From March 2020 to December 2020, the stock price shot up, gaining over 700%. This amazing rise happened because of several things:

- The company kept growing production despite worldwide challenges

- It made a profit for five quarters in a row

- It joined the S&P 500 index in December 2020

- Small investors showed a lot of interest through apps like Robinhood

Tesla split its stock 5-for-1 in August 2020, which made shares easier for small investors to buy. Also, when Tesla joined the S&P 500, index funds had to purchase shares, which led to a huge surge in buying. Tesla hit its highest price ever by January 2021, making Elon Musk the richest person in the world.

2022–2025: Politics and EV Rivals Cause Price Swings

Tesla’s stock became more unpredictable after its 2021 peak. The price fell a lot in 2022 as interest rates went up and Musk sold shares to buy Twitter. His growing involvement in politics also turned off some investors and customers.

From 2023 to 2025, Tesla faced new challenges as competition grew fiercer. Traditional car makers and Chinese firms like BYD stepped up their game. Still, Tesla didn’t back down. The company kept building new Gigafactories and giving its product line a fresh look.

During this time, Tesla’s stock went on a rollercoaster ride. Investors couldn’t agree on what the future held for the company. Some worried about the slowing pace of electric car adoption. Others got excited about Tesla’s chances in self-driving taxis, AI, and storing energy. This up-and-down movement showed how hard it was to put a price tag on a company that had its fingers in so many pies, cars, energy, and tech.

Despite these hurdles, Tesla kept its top spot as the world’s most valuable car company going into 2025. However, its stock price became more affected by broader economic trends and Elon Musk’s public comments.

TSLA Stock Forecast for 2025–2026

As Tesla moves through 2025, current delivery numbers show what investors might expect in the coming years. Recent production stats give key insights for anyone following Tesla stock price predictions through 2026. These delivery and production numbers will directly influence Tesla stock price prediction 2030, as long-term growth depends on meeting these targets.

Vehicle Delivery Targets and Production Scaling

Tesla’s delivery path has hit some bumps in 2025. The first quarter saw the company deliver 337,000 cars while making 363,000, the lowest delivery number since Q3 2022. Things got a bit better in Q2, with production going up to over 410,000 cars and deliveries reaching 384,122.

Q3 2025 showed better results with 497,099 deliveries and 447,450 cars made. But Tesla still has some hurdles to overcome, as deliveries from January to September were about 1.2 million, 6% less than the same time in 2024.

Analysts expect Tesla to deliver around 1.61 million vehicles for the full year 2025, about 10% less than in 2024. To achieve this goal, Tesla must deliver 389,498 vehicles in Q4 2025.

Full Self-Driving (FSD) Rollout and Its Impact on Revenue

Elon Musk has often stressed how crucial FSD is to Tesla’s future. The company launched its first driverless robotaxis in Austin, Texas, in June 2025. Yet these cars still needed human safety monitors, which let down some investors.

The warning makes sense, given Tesla’s track record with FSD. Back in April, Musk said we’d see “millions of Teslas driving themselves by the second half of next year.” For sure, if FSD works out, it could change how Tesla does business, maybe moving from selling cars to offering pricey software services.

People who know the industry doubt this will happen so soon. One expert in self-driving tech said, “Look how long it’s taken Waymo? There’s no reason to believe Tesla will be any faster”.

Price Predictions: $216 to $786 Range

Predictions for Tesla’s future performance through 2026 show a lot of differences. In the coming year, experts think the stock might drop by 20.52%, with an average price target of $341.63. The predictions range from a low of $19.05 to a high of $600.

Looking ahead to 2025, profit forecasts have gone down. The average earnings per share estimate is now $1.74, lower than the $1.90 predicted three months ago. Also, Tesla’s profit margins have shrunk by half in recent years, reaching 8% in the past 12 months.

When we look at predictions for the future, CoinCodex expects Tesla stock to move between $180.27 and $638.37 throughout 2026, with an average price of $431.96.

Cathie Wood’s 2025 Target vs Analyst Consensus

Ark Invest’s Cathie Wood has a much more positive outlook than most. Unlike most analysts, Wood thinks Tesla’s price will reach $2,600 by 2030.

Wood’s optimistic view depends on Tesla’s potential beyond cars, robotaxis and Optimus robots. She thinks FSD will drive Tesla’s future robotaxi business, making up 90% of the stock’s value by 2030. Cathie Wood’s bold Tesla stock price prediction 2030 assumes a major shift from car sales to AI and robotaxi revenue.

Most analysts are much more cautious. The average Wall Street analyst gives Tesla a “Hold” rating, with 20 Buy ratings, 17 Hold ratings, and 8 Sell ratings. In fact, some analysts think Tesla stock could drop 50% in the next five years as its P/E ratio goes down from current levels.

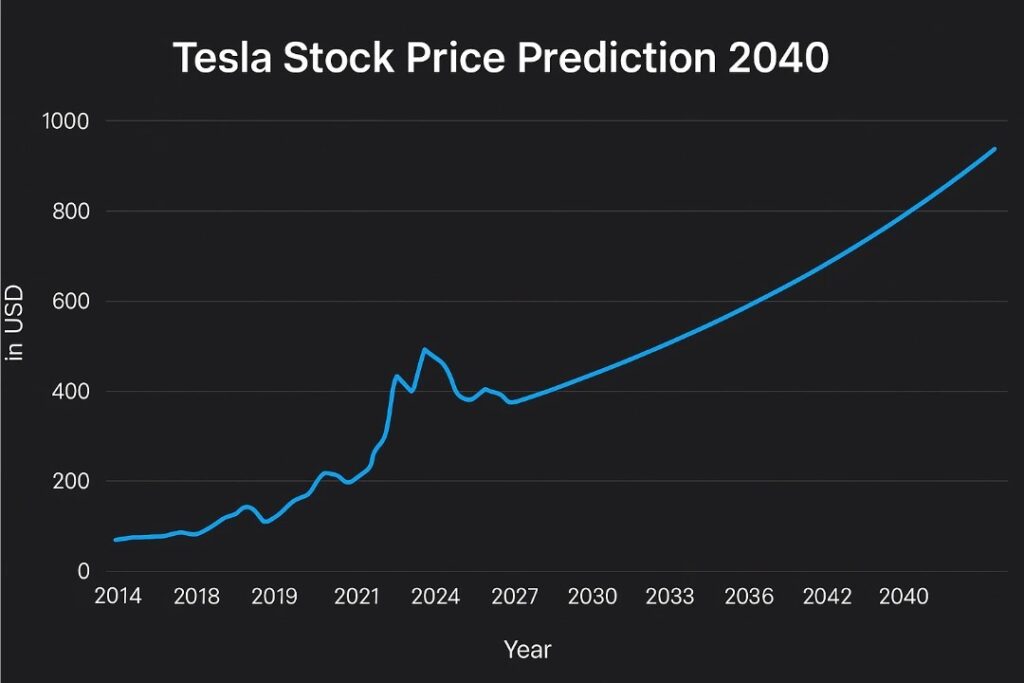

Tesla Stock Price Prediction 2030: Analyst Scenarios

Analysts tell very different stories about Tesla’s future. Let’s look at what the stock might be worth by 2030 in three different scenarios. When looking at different Tesla stock price prediction 2030 scenarios, it’s clear that analysts are split between bullish and cautious outcomes.

Bullish Case: $2,600+ Powered by Robotaxis

The most upbeat outlook comes from Cathie Wood’s ARK Invest, which predicts Tesla shares will reach $2,600 by 2029. In fact, their best-case scenario suggests a potential increase to $3,100 per share. This striking forecast hinges on one game-changing assumption: robotaxis will generate almost 90% of Tesla’s enterprise value.

What’s behind this positive thinking? ARK thinks Tesla’s self-driving ride-hailing business could tap into a $10 trillion global market opportunity. With software-as-a-service profit margins over 80%, robotaxis would yield much higher profits than Tesla’s current EV business. , ARK envisions Tesla changing from a car company into a high-profit robotaxi platform. If Tesla ventures into consumer electronics, the rumored Tesla Pi Phone could become part of its ecosystem strategy.

Bearish Case: $438 Due to Market Saturation

At the other end, bearish analysts such as Gov Capital predict Tesla will reach $348.87 by the end of 2030. Critics point to Tesla’s shrinking U.S. market share, which dropped below 40% for the first time since 2017.

The bear case shows worries about growing competition and market saturation. Tesla faces tough fights from Chinese makers like BYD, which is set to pass Tesla as the world’s biggest EV seller. Another concern: the company’s main car business remains its cash cow while Musk turns his attention to robotaxis and humanoid robots.

Average Forecast: $762 Based on EV Growth Trends

Between these two ends lies a more balanced forecast. CoinCodex predicts an average price of $754.70 by 2030, ranging from $454.51 to $1,005.75. This middle-ground estimate still shows a possible 134% return from today’s levels.

This modest outlook assumes Tesla keeps its spot as a top EV manufacturer while improving in self-driving tech and energy. Right now, most Wall Street experts give Tesla a “Hold” rating, hinting at a careful but not negative view.

What Will Tesla Stock Be Worth in 2030?

The wide range of predictions, from $348 to over $3,000, shows how Tesla’s future depends on execution. A look at various forecasts reveals that most analysts group around three scenarios:

- Transformation: $2,000-$3,100 if robotaxis grow

- Evolution: $700-$1,000 if Tesla expands across multiple businesses

- Competition: $350-$450 if market saturation and rivals restrict growth

The direction Tesla takes relies on whether its self-driving technology can meet Musk’s bold promises. One analyst pointed out, “I know they’re positioning themselves as a robotics, AI company. But when you’re a car company, when you don’t have new products, your share will start to decline”. Each Tesla stock price prediction 2030 depends heavily on how fast the company can execute its ambitious plans.

What’s Driving Tesla’s Value in 2030

Five key things will push Tesla’s stock price up by 2030, each possibly adding billions to what it’s worth. These growth drivers will shape Tesla stock price prediction 2030, influencing whether the company hits the high-end targets or not.

Self-Driving Taxi Network and Software-as-a-Service Money-Making

The self-driving taxi business is Tesla’s biggest chance to make money in the future. If it works out, this network could make profits of over 60%, way more than what Tesla’s car business makes now. People who study this stuff at ARK Invest think this change could help Tesla grab up to 20% of the $10 trillion people-moving market.

When Will the Optimus Robot Hit the Market

Tesla’s robot that looks like a human might become a big money-maker if they can make lots of them as planned. Musk thinks they could make millions of Optimus robots, maybe selling each for about $20,000. They might start selling some to businesses around 2027-2028, but it’s not sure if they can make tons of them yet.

Growing Energy Storage and Solar Business

Tesla’s energy part is getting bigger fast, but people who invest don’t see how valuable it is. The company already has a big 40% of the market for home energy storage systems in the United States.

World Gigafactory Output and Market Reach

By 2030, Tesla might build more than 10 million cars each year. How well the company does in China and Europe will play a big part in how its stock performs over time.

AI and Dojo Supercomputer Profit

Tesla’s Dojo supercomputer could make $500 billion outside of car sales. This AI system might one day run everything from self-driving taxis to robots for the home.

Risks and Challenges to Watch Through 2030

When we look at what could get in the way of Tesla’s stock price in 2030, we see some hurdles the company needs to clear to hit the high targets some predict.

More EV Makers Like BYD and Old Car Companies Joining In

Chinese car makers are giving Tesla a run for its money in the market. BYD has beaten Tesla in EU sales for two months straight, getting 1.3% of the market while Tesla got 1.2%. What’s interesting is that BYD’s EU sales went up by 201.3%, but Tesla’s went down by 36.6%. Another Chinese company, SAIC Motor (MG), also sold more cars, with sales going up by 59.4%, and now has 1.9% of the European market. It’s not just Chinese companies, though. Big names like Ford, Volkswagen, and GM are stepping up their electric car game, too. Hyundai-Kia has even managed to grab almost 7% of the global electric car market.

Regulatory Risks and EV Tax Credit Policies

The end of the $7,500 EV tax credit creates big challenges for Tesla. To fight back, the company now offers a $6,500 lease credit. This move, however, puts pressure on their profits. What’s more, governments are keeping a close eye on Tesla. Canada even froze $40 million in Tesla subsidies because of worries about the company’s rebate requests. These kinds of policy changes could have a major effect on Tesla’s ability to compete in the coming years.

Elon Musk’s Political Involvement and Brand Impact

Musk’s political moves are turning customers away. Tesla’s stock dropped almost 7% when Musk said he’d start a new political party. Since December, Tesla shares have fallen 40% because of political drama. Fewer people are sticking with the brand. For every household that leaves Tesla, fewer than two new ones join – the worst loyalty rate ever. What’s worrying: sales dropped 45% in Europe and 70% in Canada as these issues unfolded.

Supply Chain and Lithium Dependency

Supply chain weaknesses pose another big risk. Tesla needs about 139,000 metric tons of nickel each year, but rising prices for key battery metals cut into profits. Also, China processes 70-80% of the world’s lithium and might tighten rules on refining tech. Aware of these issues, Tesla moved its silicon anode buying from China to Korea and started a lithium refinery in Texas. Still, battery supply chains stay “complex, global, and fragile”, which could limit Tesla’s ability to grow production until 2030.

Conclusion

In summary, Tesla stock price prediction 2030 remains uncertain, but one thing is sure: the company’s ability to innovate will define whether it becomes a $3,000 stock or stays near $450. Tesla’s stock path through 2030 will be as unpredictable as before. The broad span of price targets – from $348 to over $3,000, indicates how split experts are about Tesla’s future. In the end, your opinion on Tesla stock hinges on which narrative you buy into.

Will Tesla turn into a robotaxi company and hit $2,600+ per share? Or will rising competition and market saturation keep it around $450? Maybe the middle ground of $762 makes more sense as Tesla keeps changing its EV business while working on new technologies.

One thing’s for sure, Tesla’s success depends on how well it performs. The company needs to keep its big promises about self-driving cars. Tesla also has to fight off tough rivals BYD and other Chinese carmakers who are catching up fast.

On top of that, Tesla has to deal with government rules, handle supply chain risks, and cope with how Elon Musk’s growing political activities affect things. The company’s fan base has already taken a hit, with fewer sales in key places like Europe and Canada.

What should investors expect by 2030? Instead of aiming for a specific price target, it makes more sense to watch how Tesla meets key milestones. The successful launch of robotaxis, the market entry of Optimus robots, expansion in energy storage, and growth in manufacturing capacity will all indicate whether Tesla is heading towards the optimistic or pessimistic scenario.

Let’s not forget, Tesla has shown time and again that it can prove doubters wrong. But we can’t assume past wins guarantee future success as more players enter the EV market. The company that caused a revolution in electric vehicles now faces its biggest challenge yet, showing it can grow into much more than just a car maker.

FAQs

Q1. What is the projected stock price range for Tesla in 2030?

Experts have different views on Tesla’s stock price for 2030. Their estimates go from about $350 to more than $3,000 per share. The most upbeat forecasts think Tesla will do well in the robotaxi market. The more cautious ones take into account more rivals and the full market.

Q2. What are the key factors that could drive Tesla’s valuation by 2030?

The key factors that have an influence on Tesla’s future value include building its robotaxi network, bringing the Optimus robot to market, growing its energy storage and solar business, boosting its worldwide manufacturing ability, and making money from its AI and Dojo supercomputer tech.

Q3. How could rivals affect Tesla’s market standing in the years ahead?

Tesla now faces more competition from big car companies and new EV makers from China. Firms like BYD are winning more customers in important areas like Europe, which might slow Tesla’s growth and cut into its profits over time.

Q4. What dangers could hurt Tesla’s stock performance through 2030?

The main risks Tesla faces include tougher competition in the EV market, shifts in government EV incentives, possible harm to its brand from Elon Musk’s public comments, and weak points in its supply chain for battery materials like lithium and nickel.

Q5. How crucial is Tesla’s self-driving technology to its future worth?

The success of Tesla’s Full Self-Driving (FSD) technology has a big impact on its long-term value. If Tesla can create self-driving cars and launch a big robotaxi network, it could boost the company’s income and profits. But it’s still unclear when this might happen.