Table of Contents

5starsstocks .com says it has a 70% accuracy rate for stock picks. But take that with a grain of salt. An independent study put this claim to the test with shocking results. The verified accuracy of its picks was only 35%, essentially a coin toss and half of what the platform claims.

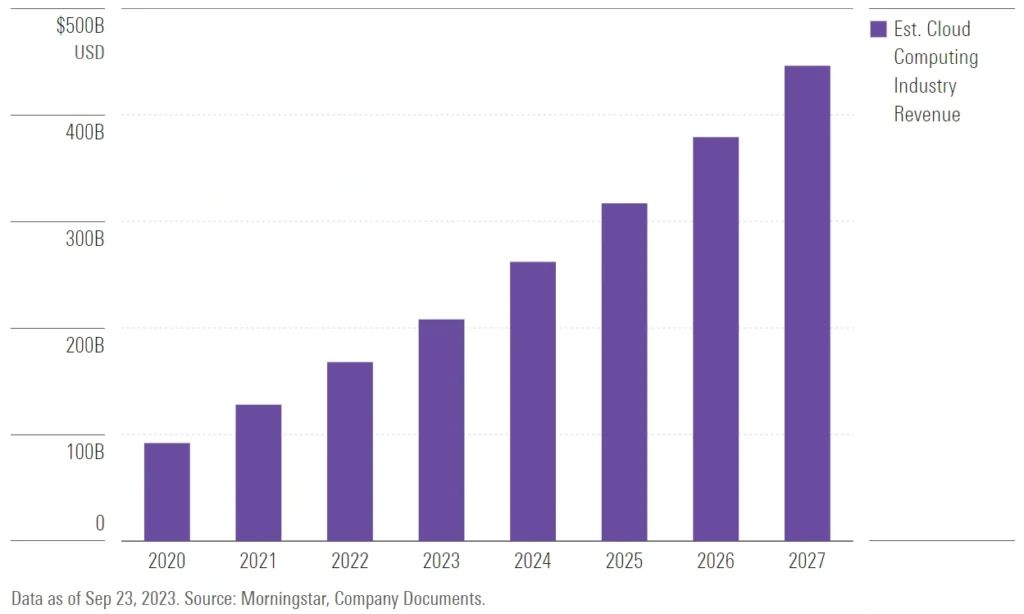

Despite these findings, the stock recommendation industry continues to boom. A 2023 report shows the market is set to grow from $6.7 billion to $22.6 billion by 2027. About 40% of users are under 35. One-third of them are students or first-time investors. Many platforms, like 5starsstocks.com, aim at beginners with claims of easy wins.

In this guide, I’ll show you what 5starsstocks.com offers. You’ll learn how its AI and rating system work. Plus, we’ll see if it can really help you find winning stocks. We’ll also check out success stories, like Sarah. She doubled her investment in just six months using the platform. We’ll also discuss some less well-known failures. The stock market isn’t a get-rich-quick scheme. But with the right tools, like 5starsstocks.com, it can fit into your investment strategy.

What is 5starsstocks .com and how does it work?

5starsstocks.com is different from many financial websites. You can’t buy or sell investments here. Instead, it functions as a data-driven stock analysis solution that launched in 2023. This platform uses artificial intelligence to check publicly traded companies across various sectors.

Not a trading platform, but a research tool

The platform operates strictly as a research service providing recommendations and market commentary. When you log in, you’ll see stocks rated on a five-star scale. This rating reflects their performance history, growth potential, and risk factors. Also, all this information comes through a clear, easy-to-use interface. It won’t overwhelm you with technical terms.

Target audience: beginners and busy investors

5starsstocks.com focuses on two main groups: newcomers who need guidance and busy professionals who want quick insights. The site’s educational resources include step-by-step tutorials explaining stock valuation and technical indicators. Busy investors love how the platform cuts through market noise. It gives them clear, actionable insights.

How it simplifies stock analysis

What makes 5starsstocks .com stand out is its approach to simplification. The platform turns complex market trends into easy-to-read color signals. This helps you make decisions with less guesswork. You can use advanced screening tools to filter stocks. You can sort them by sector, valuation metrics, and risk profile. So, finding opportunities that match your investment strategy becomes significantly easier.

How the AI and 5-star rating system actually function

At 5starsstocks.com, the simple star ratings come from a powerful AI engine. This engine analyzes huge amounts of data. Let’s peek under the hood to understand what is really happening.

What data does the AI use?

The AI powering 5starsstocks .com digests multiple data streams simultaneously. It analyzes financial statements, earnings call transcripts, social media discussions, news articles, and macroeconomic indicators. This hybrid approach combines machine learning algorithms with human analyst oversight. The system uses Natural Language Processing to analyze news and social media. This helps spot changes in sentiment before they impact stock prices.

How the 5-star ratings are calculated

Each star rating represents a weighted evaluation of five key factors:

- Financial Health (25%): Balance sheet strength, cash flow, and profit margins

- Growth Potential (25%): Revenue trajectory, earnings projections

- Valuation (20%): P/E ratios, comparison to peers

- Market Sentiment (15%): News tone, social media mentions

- Risk Assessment (15%): Volatility measures, sector-specific risks

Limitations of the ‘black box’ model

The platform works like a “black box.” You can see the inputs and outputs, but you don’t know what happens in between. Moreover, there is minimal disclosure about specific algorithms, weighting systems, or data sources. This opacity makes independent verification impossible. Users don’t see how recommendations hold up in different market cycles. So, they end up trusting untested promises over real results.

Why transparency matters in AI-driven investing

Transparency builds trust. Investors need to see how AI models work to understand their recommendations. Without clear explanations, detecting algorithmic bias becomes extremely difficult. Additionally, regulatory requirements increasingly demand explainability in AI decision-making, particularly in finance. The best systems keep human oversight. They use “human-in-the-loop” models, which let people review and override AI outputs.

Key features that make 5starsstocks .com stand out

What truly sets 5starsstocks .com apart from other investment platforms? Let’s look at the key features that make this tool valuable for all investors.

Real-time market data and alerts

The platform delivers instant updates throughout trading sessions. The Smart Alerts System goes beyond basic price notifications. It uses predictive algorithms to send alerts. These alerts go off due to unusual volume patterns, changes in insider activity, or sudden shifts in sentiment. Get these customizable alerts in seconds, not minutes. This lets you react quickly to market opportunities. Get updates on major price changes, breaking news, and earnings announcements. You can receive these alerts via email or check them on your dashboard.

User-friendly interface and mobile access

5starsstocks.com stands out with its clear and easy layout, making financial platforms less overwhelming. The design works equally well for beginners and experienced traders. The mobile app maintains full desktop functionality, enabling trading and portfolio tracking anywhere. Cross-platform sync keeps your portfolio updates and alerts current on all devices. This is especially important on volatile trading days.

Educational resources for beginners

New investors gain access to resources tailored to all experience levels. Beginner guides cover basic concepts. Advanced tutorials dive into technical analysis. Together, these materials build knowledge step by step. Interactive quizzes help reinforce what you’ve learned without pressure. Webinars and community forums allow users to share insights and exchange ideas.

Custom dashboards and watchlists

The watchlist functionality offers flexibility for different strategies. Create separate lists for growth stocks, dividend plays, and sector-specific investments like healthcare or defense. The stock screening tool lets you filter by criteria such as P/E ratios, market cap, and dividend yield. Your personalized dashboard brings together watchlists, market news, alerts, and portfolio performance, all in one easy spot.

Breaking down the stock categories on 5starsstocks.com

5starsstocks.com features eight specialized stock categories, each offering unique investment traits.

5starsstocks.com value stocks

5starsstocks.com focuses on value stocks. It targets companies that trade below their true worth.

The system checks stocks using metrics such as:

- Price-to-earnings ratios (looking for a PE below 14)

- Price-to-book values

- Free cash flow

This approach appeals to patient investors looking for long-term stability and dividends.

5starsstocks.com blue chip

5starsstocks.com focuses on blue-chip selections. These are established companies that are financially sound and have proven track records. These reliable businesses typically feature consistent earnings, recognizable brands, and solid market positions. The platform claims its blue chip picks have earned annual returns of 8-12% in the last five years.

5starsstocks.com healthcare

5starsstocks.com healthcare stocks cover pharmaceutical development, medical devices, and biotechnology advancements. This category emphasizes companies with extensive drug pipelines and innovative patient care services. Healthcare investments remain attractive because they typically thrive despite economic downturns.

5starsstocks.com defense

5starsstocks.com defense stocks include aerospace companies, cybersecurity firms, and military technology providers.

The platform sorts them into themed picks:

- “Grow Big”: high-growth stocks

- “Stay Steady”: stable, dividend-paying companies

- “Try New”: emerging players

Defense investments often maintain stability during uncertain economic periods.

5starsstocks.com military

5starsstocks.com covers military stocks, which overlap with defense. It focuses on weapons makers, defense contractors, and tech firms that provide intelligence services. This category benefits from growing defense budgets worldwide.

5starsstocks.com cannabis

5starsstocks.com cannabis stocks cover cultivators, dispensaries, biotech firms, and ancillary service providers. The platform offers cannabis-focused analytics. It covers updates on regulations and tracks compliance in both the U.S. and Canada. Some users report big losses with cannabis recommendations. One investor noted a 67% drop, even with a “strong buy” rating.

5starsstocks.com lithium

5starsstocks.com lithium stocks include mining companies and battery technology startups. This category serves investors interested in clean energy and electric vehicle growth. A user said a lithium battery stock was their “biggest winner,” rising 34% in two months.

5starsstocks.com passive stocks

Passive stocks offer steady returns with minimal maintenance. They provide investors with balanced portfolios focused on long-term growth. The platform focuses on companies with quick ratios over 1.0. It also highlights those with steady growth in dividends.

Does it really help to pick winning stocks?

Let’s look at the real performance data for 5starsstocks.com, not the marketing claims.

Independent performance analysis

The reality check is sobering. A comprehensive four-month study tracking 5starsstocks .com recommendations showed disturbing results. Test portfolios following the platform’s advice lost 5.6% while the S&P 500 gained 8.2% during the same period. This represents a large 13.8-percentage-point underperformance.

Sector performance varied dramatically. Defense stocks were the best performers, averaging +18%. Lithium-related picks followed with +12%. In contrast, cannabis recommendations faced major losses, averaging -31%.

Claimed vs. verified accuracy

5starsstocks.com says it has a 70% success rate. However, independent tests tell a different story. The actual verified accuracy? Only 35% of recommendations proved profitable. Following the platform’s advice was almost as good as flipping a coin.

ScamAdviser gives the site a moderate trust score of 66/100, indicating “neither high nor low risk.” Nevertheless, this lukewarm assessment hardly inspires confidence.

User success stories and failures

On the positive side, some users reported significant gains. An investor watched a lithium battery stock rise by 34% in only two months. Defense stock picks generally provided modest, positive returns.

Conversely, failures were dramatic. A cannabis stock labeled “strong buy” plummeted 67%. Another investor lost 23% in just one week on a small-cap 3D printing company. This happened when cash flow issues appeared, which the platform’s analysis missed.

When the platform works and when it doesn’t

5starsstocks.com is a great starting point for research. It’s not meant to be your main decision-making tool. Users see better results with long-term sector allocation than with picking individual stocks. The educational content is great for beginners. The real-time alerts system helps with risk management when used wisely.

How to use the platform effectively in 2025

Getting started with 5starsstocks.com requires a simple approach. First, create your account. Then, take some time to explore the dashboard. This helps you understand the tools available. Once registered, customize your profile by setting investment preferences to receive tailored recommendations.

The key to success lies in clear planning. Define your investment goals, whether monthly income, long-term growth, or retirement savings. Next, create a focused watchlist of 5-10 stocks using the platform’s star ratings. But don’t rush to buy them right away.

Always follow this golden rule: cross-verify picks with other trusted sources. Set concrete risk limits by deciding how much you’re willing to lose per trade. Customize alerts to avoid information overload, focusing only on relevant notifications.

The platform offers three subscription options:

- Free Plan: Limited stock picks and basic educational content

- Premium Plan ($29.99/month): Full access to curated picks and real-time alerts

- Pro Plan ($99.99/month): Premium features, plus analyst Q&A sessions

Diversify intelligently by balancing your portfolio with dividend, growth, and low-risk options. Reinvesting dividends rather than cashing out can accelerate portfolio growth over time. Engage with the community forums. Connecting with other investors gives you valuable insights into market trends.

Conclusion

After looking at 5starsstocks .com from all angles, the picture becomes clear. This platform provides exciting AI-driven stock ratings and analysis tools. However, it does not fully deliver on its big promises. The claimed accuracy rate is 70%, but the verified rate is only 35%. This shows why we should be cautious about trusting marketing claims.

You might find value in certain aspects of the platform. The clean interface, real-time alerts, and educational resources help beginners tackle investing’s complexities. Specialized stock categories, like defense and lithium, have also performed well. Users report gains of up to 34% in some cases.

But the significant underperformance compared to standard market indexes raises serious questions. Test portfolios based on 5starsstocks.com advice lost 5.6%. In contrast, the S&P 500 gained 8.2%. This makes us question the platform’s true value.

The platform works best when you use it as just one tool in your investment arsenal rather than your sole decision-maker. Cross-verification remains essential, never invest based solely on these recommendations. Success stories often come from investors who started their research on the platform.

Smart investors see the limits of AI systems. These systems often act like “black boxes” and lack transparency. Not seeing how recommendations perform in various market cycles should raise caution. If you’re curious about 5starsstocks.com, begin with the free plan. Then, you can decide if you want to upgrade to a premium subscription. Use educational resources and screening tools. Don’t follow stock picks without understanding. Set strict risk limits and diversify across different categories to cut potential losses.

Remember that no platform can replace fundamental investment principles. Thorough research, diversification, and patience still form the cornerstone of successful investing. 5starsstocks.com can be useful in your toolkit. But it shouldn’t be the core of your investment strategy.

Above all, approach any stock recommendation service with healthy skepticism. The market is still unpredictable. Even with new technology, no algorithm has mastered its complexities. Your financial future deserves more than blind faith in five-star ratings.

FAQs

Q1. How accurate are 5StarsStocks.com’s stock recommendations?

Independent studies show the platform’s real accuracy is about 35%. This is much lower than the claimed 70% success rate. Be cautious with their recommendations. Use them as a starting point for more research, not as final investment advice.

Q2. What features make 5starsstocks.com stand out from other stock analysis platforms?

Key features include real-time market data and alerts, an intuitive interface that allows mobile access, educational resources designed for beginners, and dashboards and watchlists that users can customize. These tools help simplify stock analysis. They make it easier for both new and experienced investors.

Q3. How does 5StarsStocks.com’s AI rating system work?

The AI looks at many data sources. It checks financial statements, news articles, and social media sentiment. It calculates a 5-star rating. It looks at factors such as financial health, growth potential, valuation, market sentiment, and risk assessment. However, the specific algorithms and weighting systems are not fully disclosed.

Q4. Can 5starsstocks .com help me pick winning stocks consistently?

Some users had success with certain stock picks. But the performance has been mixed. Test portfolios following the platform’s advice have underperformed market indexes in some studies. Use 5starsstocks.com as one tool in your investment strategy. Don’t rely on it alone.

Q5. What subscription options does 5starsstocks .com offer?

The platform offers three subscription tiers: a free plan with limited features, a $29.99/month premium plan that offers full access to curated picks and real-time alerts, and a Pro plan at $99.99/month that includes premium features plus analyst Q&A sessions.