Real-time expectations are breaking old finance systems.

Consumers now demand instant transfers, immediate decisions, and 24/7 access to their money. But the conventional financial infrastructure powering most banks isn’t built for this kind of speed or scale.

Meanwhile, pressure is rising in the finance sector.

Fraud is up. AI is creating security concerns. And compliance costs are eating into margins. Additionally, legacy tools and outdated workflows can’t keep pace.

That’s where the fintech industry steps in.

From rethinking credit to reinventing cross-border coordination, fintech is changing the entire system. Let’s take a closer look at the technologies transforming the financial world and their potential impact on the future.

The Fintech Shift: Why 2030 Will Look Nothing Like 2020

A few years ago, fintech was all about better apps. But now, it’s about reinventing the entire system.

But why now?

The world has hit an inflexion point where technology is allowing financial institutions (FIs) to evolve. AI-driven solutions are reliable, interoperability is real, and consumer demand is relentless. In fact, 90% of fintech firms say rising customer demand for their services is their biggest growth driver.

So what’s changed?

Traditional finance tools are siloed. However, modern fintech platforms can automate credit approvals, monitor for fraud, and provide real-time data analytics through a single interface.

Fintech infrastructure is simply faster and smarter.

As a result, conventional banks are losing ground to digital channels. 85% of Millennials say they’d bank with a nontraditional provider like Apple, PayPal, or Amazon. This shift in brand trust changes the entire playing field.

And sure, it comes with its challenges.

Fintechs expanding globally still struggle with complex regulatory frameworks and cross-border licensing.

But for fintech leaders who can solve those problems, the growth potential is massive.

7 Disruptive Technologies Shaping the Financial World

From stablecoins to AI agents, these technologies are foundational shifts.

Banks and infrastructure providers use them to move money, manage risk, and stay compliant at scale.

Each one plays a key role in shaping what finance in 2030 will look like. (And how businesses should prepare now.)

Here’s what’s redefining financial services:

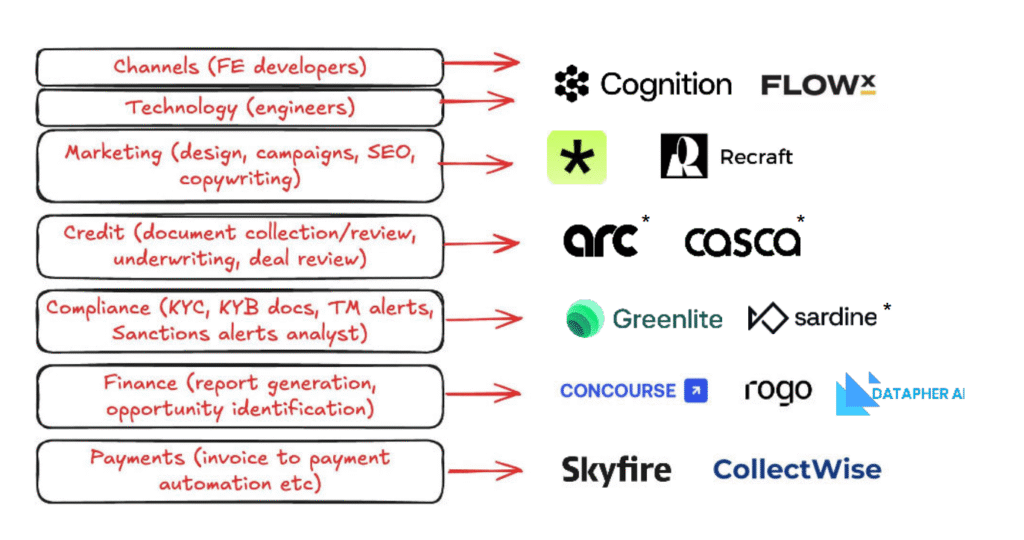

1. AI Agents and Automation

Gartner predicts that by 2028, AI-driven third-party assistants built into customers’ mobile devices will handle 70% of customer service journeys.

And banks are already on board.

Banks are using AI-powered systems to automate everything from onboarding to fraud prevention.

Take Morgan Stanley.

The banking giant already uses AI to summarize insights for advisors.

Or look at BBVA.

The digital bank has deployed thousands of GPTs to streamline credit checks and extract data from PDFs.

And in terms of customer service advantages, look at Klarna.

The “buy now, pay later” service now uses AI chatbots to handle two-thirds of its customer service, equating to the work of 700 full-time agents. This has cut response times from 11 minutes to under two.

It’s no surprise, then, that nearly 20% of banks have ranked AI as a top investment priority, with automation at the heart of its benefits.

2. Embedded Finance and B2B Infrastructure Innovation

Finance is no longer a separate destination. It’s baked into the tools people already use.

Whether it’s e-commerce apps or automated expense controls, embedded finance is everywhere.

For businesses, this shift comes down to the need for financial infrastructure that supports seamless operations, cross-platform interoperability, and real-time efficiency. Unfortunately, legacy banking systems are too fragmented, slow to integrate, and costly to scale. They’ve become a poor fit for modern digital business systems.

Tools like Ramp exemplify exactly how embedded finance offers businesses better access and control.

It has fintech features built directly into its secured business credit cards. Think accounting integrations, real-time spend controls, and automated analytical tools. This gives businesses a single, seamless platform to manage all their financial operations.

The result? Less time switching between tools, fewer manual errors, and faster decisions.

For startups and small businesses, especially, this kind of all-in-one infrastructure reduces complexity and makes scaling smoother. And they don’t need a full finance team to stay on top of it all.

It’s not just consumer demand driving this evolution.

Banks are also moving from standalone financial services to integrated, real-time systems. In fact, 35% of bank executives now prioritize fintech tools that enhance operational efficiency. (They’re no longer simply focused on front-end experiences.)

3. Stablecoins and Tokenized Financial Systems

Blockchain technology isn’t dead. It’s only just getting started.

Stablecoins are now moving from the fringe to the foundation of modern payments.

In 2024 alone:

- Mastercard and Metamask teamed up on a self-custody debit card.

- Stripe acquired Bridge, a stablecoin startup, for $1.1 billion.

- Visa launched a Tokenized Asset Platform for banks.

- PayPal enabled crypto for business accounts.

But why the drive toward stablecoins and distributed ledger technology?

Because cross-border payments are expensive, slow, and outdated.

In contrast, stablecoins offer programmable, instant alternatives with lower costs, built-in transparency, and stronger security.

And FIs are already on board.

As payment rails evolve, 33% of banks are making payment technologies their top two investment priorities. (So, expect tokenization to become part of everyday finance.)

4. Neobanks and Mobile Wallets

In the early days, fintech companies focused on one of three things: loans, transfers, or crypto.

However, we are now witnessing the great rebundling. Fintech companies are expanding into other financial verticals to offer comprehensive, all-in-one services.

Neobanks, super apps, and digital wallets now offer savings, investments, insurance, and identity management in one place.

Why now?

Because consumer behavior demands it.

Mobile-first isn’t optional anymore … it’s expected. And especially among the younger generations. 81% of adults used a phone to manage money in the last month, while most Gen Z and Millennials now treat their mobile as their primary banking channel.

But it goes beyond easier access to finances. Gen Z also values personalization more than any previous generation. They expect tailored insights, smart automation, and seamless tools.

Ultimately, users want intuitive, all-in-one experiences — not 12 different logins.

That’s why digital banking solutions are now the #1 fintech investment focus for 55% of banks.

In other words, wallets aren’t replacing bank cards. They’re fast becoming the new financial hub.

5. AI-Driven Wealthtech and Hyper-Personalized Investing

AI-driven insights are transforming the wealth management space. AI tools bring automated advice and scalable personalization to investing.

Whether it’s risk assessments or algorithmic portfolios, modern wealthtech platforms use machine learning to serve clients at scale.

And the sector is growing.

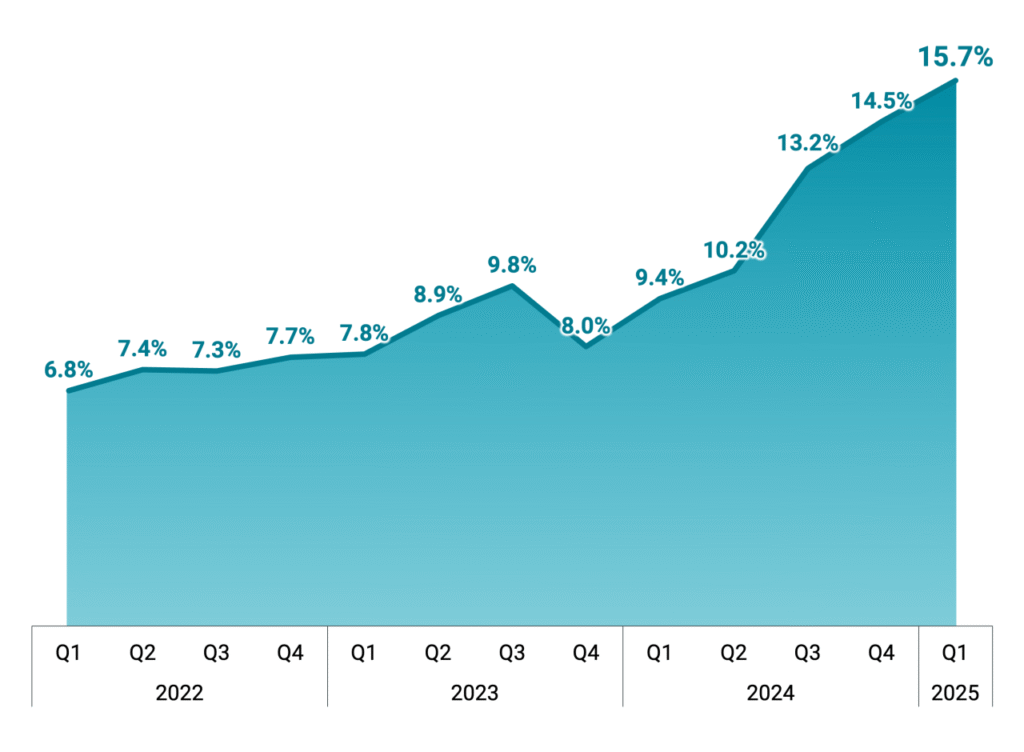

11% of fintech activity now falls under wealthtech, and funding for AI fintechs has doubled since 2023. AI insights and personalized products are no longer the domain of early adopters. They’re becoming standard practice.

Take Abacus Global, for instance.

As a leader in next-generation investment tools, the financial assets firm is pairing automation with human expertise. This results in smarter, quicker, and more personalized portfolio management.

This kind of hybrid model is exactly what’s shaping the future of wealth. It combines AI precision with advisor insight to meet rising expectations for performance and trust.

6. Regulatory Tech and Real-Time Risk Management

Compliance and risk management aren’t simply box-checking exercises. They’re crucial to the survival of financial institutions. And it’s a race against time.

With fraud and deepfakes on the rise and increased regulatory scrutiny, FIs need systems that can respond instantly.

As a result, financial entities are now using AI-powered systems and regulatory technology (regtech). These tools monitor transactions and enhance anti-money laundering (AML) and KYC compliance.

In fact, 31% of banks now rank risk management in their top two investment areas.

Expect to see more:

- Real-time monitoring tools

- Automated reporting

- Predictive analytics

7. Intelligent Data and Predictive Analytics Tools

As banking gets faster, smarter, and more embedded, data is the fuel powering the engine.

Financial firms are no longer simply collecting information. They’re using it to drive real-time decisions, personalize services, and identify risks before they impact the balance sheet.

In fact, almost 40% of banks rank data analysis and customer insights as one of their top investment priorities. That includes everything from credit tools and behavioral analytics to fraud systems and forecasting platforms.

And it’s not just the banks.

Consumers, investors, and traders seek tools that transform data into actionable insights, enabling them to navigate volatile markets with confidence.

Take LuxAlgo, for example.

Trading indicators from LuxAlgo give users real-time insights through trend detection, volatility signals, and behavioral patterns. Instead of staring at static charts, anyone can act on live signals and make faster, smarter calls about their money.

This means better access to investment opportunities, without the need for deep trading expertise.

In this sense, intelligent data analysis is helping to level the playing field. It’s improving financial inclusion, rewriting who gets to win in the market.

Wrap Up

From AI agents to embedded finance, the next wave of fintech offers revolutionary ways to manage money.

These tools aren’t isolated trends.

Together, they point to a clear direction. Financial services are becoming faster, smarter, and more personalized. And they’re deeply integrated into the tools we already use.

And that’s the real story of fintech in 2030.

We’re beyond the point of disruption. Now it’s about transformation at every level of the financial world.

However, remember that the future of finance won’t be shaped by who holds the most data. It’ll be shaped by those who know how to use it best.

To keep ahead of the curve and read the latest fintech insights and financial innovation news on TechTidel.